To provide your company with day-to-day accounting capabilities, Web Suite comes with some core accounting features that make it easier to keep track of accounts receivable and payable, client and vendor transactions and so on. The accounting tasks are typically performed by billing managers and accountants, or can be delegated to the admin staff.

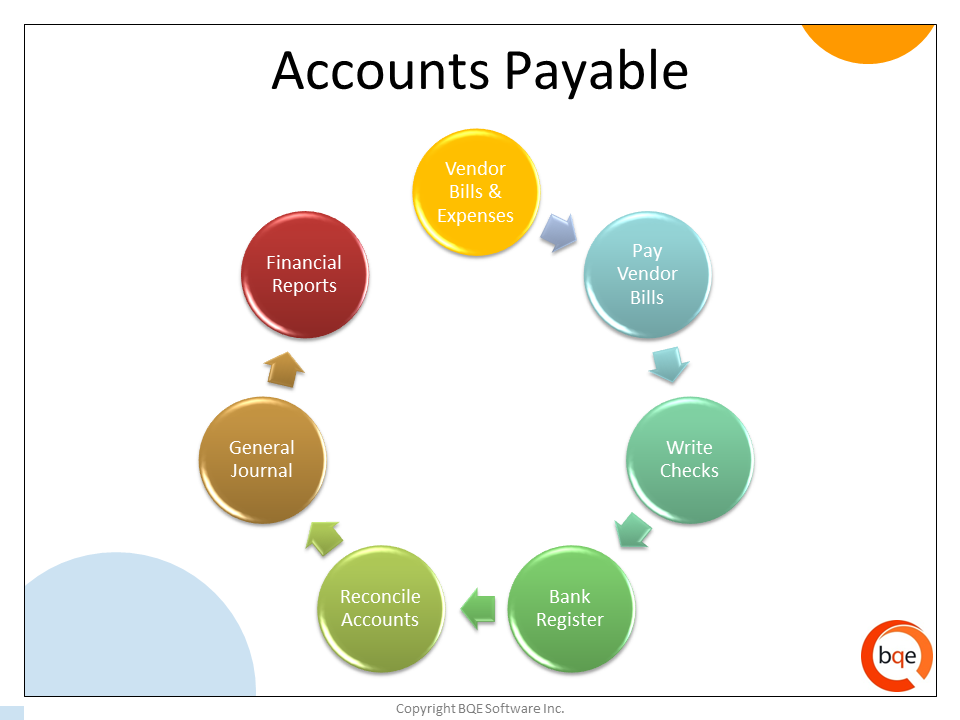

Accounts Payable (A/P) represents money that the company owes to the vendors for products and services purchased on credit. Both vendor bills and employee reimbursable expenses contribute toward A/P and hence need to be paid. You can perform A/P related tasks in Web Suite including creating accounts, paying vendor bills, writing checks, entering in bank registers, reconciling accounts, making journal entries, etc.It enables you to track company expenses and what you owe to vendors or others.

Before using the A/P features, we recommend specifying related settings in the Global Settings-Accounting screen. You can choose the default A/P accounts, and switch between cash and accrual basis of accounting without messing the accounts in Web Suite. In an accrual-based accounting system,

Invoices = Income

Vendor Bills = Expense

In a cash-based system,

Payments/Deposits = Income

Pay Bills or Expenses = Expense

To use the Accounts Payable features, you need to create an A/P account (such as Bank or credit card account) that automatically adds to your Chart of Accounts. Web Suite uses this account to track the money your company owes to others. You can then pay your vendor bills in the Pay Bills screen and print the checks for the vendors. When you pay a vendor bill, the related expense entries are marked as paid if the vendor bill is paid in full. You can write checks to pay off bills or reimburse your employees. Checks can be printed immediately or later, as required.

Whenever you pay outstanding vendor bills or write checks, Web Suite records the transaction in a register for your A/P account. In Web Suite, when a vendor bill is entered, the expense or other specified account is debited while the Accounts Payable account is credited. Furthermore, when vendor bills are paid, the A/P account is debited and the Bank Account is credited. You can keep track of your accounts payable using the A/P reports and registers. If you credit an A/P account, it increases the A/P amount, while as when you debit it, it decreases the A/P amount. If desired, you can run the aging reports for your A/P. These reports are available from the Report Center screen.

The

Accounts Payable feature is an optional module in Web Suite and is available

in the Plus versions of Web Suite Basic/Professional and Enterprise editions.

The

Accounts Payable feature is an optional module in Web Suite and is available

in the Plus versions of Web Suite Basic/Professional and Enterprise editions.

If you are just getting started in Web Suite and have older or historical balances from a manual system or software accounting system, you need to enter the opening balances to use the accounting features. To specify details and accounts for different items, you can use the Manual Invoice screen or manually enter the opening balances in the relevant A/P and A/R modules. To enter project specific balances, use the Opening Balances option on the Project-History screen.

Web Suite comes with the following system accounts:

Account ID |

Account Name |

Account Description |

Account Type |

11000 |

Accounts Receivable |

Accounts Receivable |

Accounts Receivable |

12000 |

Undeposited Funds |

Undeposited Funds |

Other Current Asset |

12010 |

Legacy Payments |

Legacy Payments |

Other Current Asset |

20000 |

Accounts Payable |

Accounts Payable |

Accounts Payable |

2100 |

Payroll Liabilities |

Payroll Liabilities |

Other Current Liability |

2200 |

Customer Deposits/Retainers |

Customer Deposits/Retainers |

Other Current Liability |

25100 |

Main Service Tax Payable |

Main Service Tax Payable |

Other Current Liability |

25200 |

Main Expense Tax Payable |

Main Expense Tax Payable |

Other Current Liability |

25300 |

Service Tax Payable |

Service Tax Payable |

Other Current Liability |

25400 |

Expense Tax Payable |

Expense Tax Payable |

Other Current Liability |

3000 |

Opening Balance Equity |

Opening Balance Equity |

Equity |

40000 |

Default Item Income Account |

Default Item Income Account |

Income |

40199 |

Default Discount Account |

Default Discount Account |

Income |

60001 |

Default Item Expense Account |

Default Item Expense Account |

Expense |

6560 |

Payroll Expenses |

Payroll Expenses |

Expense |